montana sales tax rate on cars

For example if you. You can learn more about licensing and distribution from the Alcoholic.

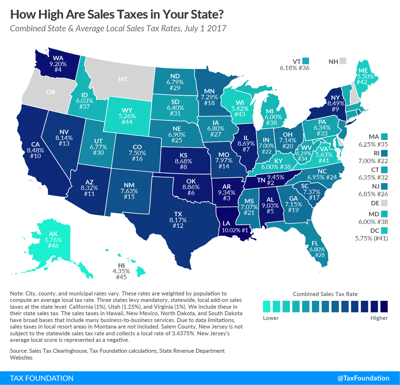

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

But this doesnt mean you wont.

. Do Montana residents have to pay sales tax in other states. Montana charges no sales tax on purchases made in the state. Certain industries such as lodging might have more than one tax.

The Montana Department of Revenue administers the states licensing distribution and taxation on Alcoholic Beverages. The luxury vehicle fee also highlights the unique tax structure that incentivizes out of state luxury vehicle owners to register their cars in Montana. The cities and counties in.

Fees collected at the time of permanent registration are. Only a few counties enforce a local state tax which is why Montanas average combined sales tax rate is only. Click here for a larger sales tax map or here for a sales tax table.

2022 Montana Sales Tax Table. There are no local taxes beyond the state rate. Heggen Law Office PCs Montana RV and vehicle registration services are designed for you to avoid sales tax and high licensing fees.

As of 2015 45 states within the United States. Since you dont have to pay sales tax on any vehicle sales in Montana there is no calculation needed. The state sales tax rate in Montana is 0000.

10 Montana Highway Patrol Salary and Retention Fee. The Butte Montana sales tax is NA the same as the Montana state sales tax. Montana has no statewide sales tax for vehicle purchases.

While many other states allow counties and other localities to collect a local option sales tax Montana does not. Instead of relying on a sales tax rate Montana levies other types of taxes plus an income tax on its resident taxpayers. Learn more about MT vehicle tax obtaining a bill of sale transferring vehicle ownership and more.

Because there is no sales tax in the state and. Up to 25 cash back If you form a Montana LLC and have it purchase and take title to a motorhome or RV you wont owe any sales tax in Montana. The Montana sales tax rate is currently.

Tax Free Montana Vehicle Registration Services. 26 rows Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. The minimum combined 2022 sales tax rate for Missoula Montana is.

How to Calculate Montana Sales Tax on a Car. County tax 9 optional state parks support certain. Montana County Vehicle Tax While Montana does not charge a state sales tax on.

This is the total of state county and city sales tax rates. 368 rows There are a total of 68 local tax jurisdictions across the state collecting an average local tax of 0002. The County sales tax.

Despite living in a state without a general sales tax citizens pay a 5 rate for their car sales. 635 for vehicle 50k or less. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

Montana to the north doesnt have a general state sales tax.

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Sales Taxes In The United States Wikiwand

Calculate Sales Tax On Car Online 56 Off Www Ingeniovirtual Com

Sales Taxes In The United States Wikiwand

Oc Only 5 States Have No Sales Tax R Dataisbeautiful

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

Sales Taxes In The United States Wikiwand

A Complete Guide On Car Sales Tax By State Shift

Montana Vehicle Sales Tax Fees Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Is Buying A Car Tax Deductible Lendingtree

Sales Taxes In The United States Wikiwand

Car Tax By State Usa Manual Car Sales Tax Calculator

Map How Much Is Sales Tax In Each State

Vehicle Buying Do You Pay Sales Tax For The State You Buy From Or Live In